epf account 2 withdrawal for house

A provision has been made in Vide Notification GSR225E dated 27032020 for withdrawal of a non-refundable advance on account of COVID-19 from the members PF account not exceeding the smaller of their basic wages and dearness allowances for three months or up to 75 of the amount standing to his. All withdrawals are subject to a minimum withdrawal of RM500 or all of Account 2 savings.

Epf Form 31 Partial Pf Withdrawal Indiafilings

There are two types of EPF Accounts.

. Related to 2020s amendment in Employees PF Scheme. Your Account 2 funds can also be used to reduceredeem a housing loan on behalf of a spouse or immediate family member. A person can withdraw his or her entire provident fund corpus after completing 58 years of age.

3 Only available to withdraw from Account 2 Account 1 holds 70 of your contributions thus youll only be able to access a smaller pool of funds. If the amount in your Account 2 is not. 30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical.

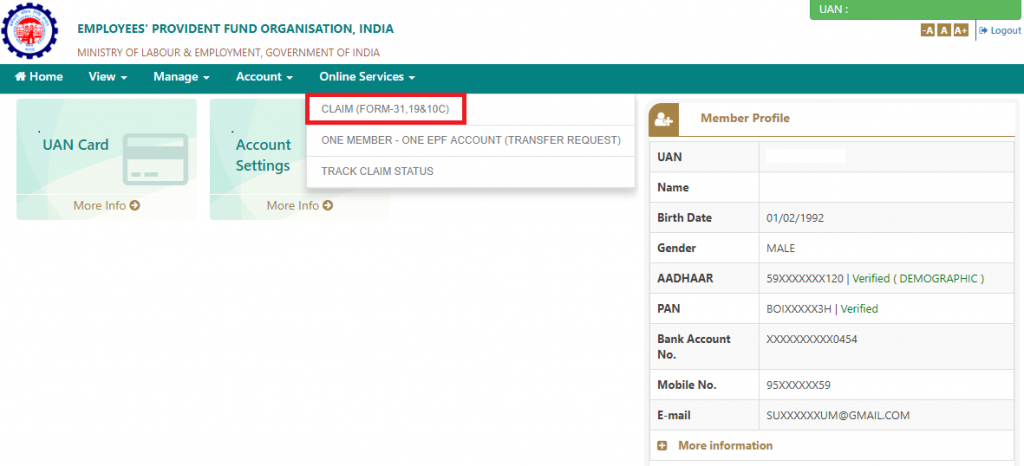

Well there are two criteria under this improvisation-. The construction cost additional 10 OR Entire savings in Account 2 whichever is lower The construction cost additional 10. From the dropdown menu select the option of Claim Form-31 19 10C The next screen that opens will display all the member details.

Proof of SaleDisposal of first house. Documents Required for EPF Loan. EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members.

Employees must submit the following. On EPF Partial Withdrawal. There are two types of EPF Accounts.

When an employee is eligible for an EPF contribution usually between 9 and 11 that percentage of their salary contributes to their EPF savings. The savings in your Account 2 can still be used for the above purposes. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house.

Savings in Account 2 can be withdrawn under specific conditions Puan. 2 The house should be in hisher name or joint ownership with a spouse. 1 The employee can withdraw funds from his EPF account for the purpose of home renovation and reconstruction.

Entire savings in Account 2 whichever is lower Difference between house construction cost and approved loan amount 10 of the construction cost OR Applicants entire savings in Account 2 whichever is lower Self-FinancingCash. When an employee is eligible for an EPF contribution usually between 9 and 11 that percentage of their salary contributes to their EPF savings. Sale and Purchase AgreementProof of MortgageSurrender of Ownership Mortgage Form Title DeedDeed of Assignment if the information in your Housing Loan Balance Statement is incomplete.

Here the funds will be divided between the two accounts. 70 of your salary contribution is transferred here. EPF Withdrawal For New House.

April 14 EPF Withdrawal For New House. The house youre going to improvemodify should be at least 5 years. A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month.

The employee is allowed to withdraw up to 90 of the provident fund balance. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs. About Flexible Housing Withdrawal Account.

You must be an active EPF subscriber for at least 10 years. EPF Account 1 receives more. 70 of your salary contribution is transferred here.

UNESCO Project - Showroom Introduction. The money youve set aside into this account belongs to you and will not be assigned to the financial institution. Before making a withdrawal youll need to evaluate based on your financing terms if the interest savings and predicted property growth matches up with dividend losses in the long run.

Withdrawn from EPF will then be credited directly to your home loan account. EPF Withdrawal For New House. EPF offers a partial withdrawal facility where the subscribers can withdraw money from their account in some cases such as purchase construction of a house repayment of a loan non receipt of the wage for two months for marriage for medical treatment of family member and so on.

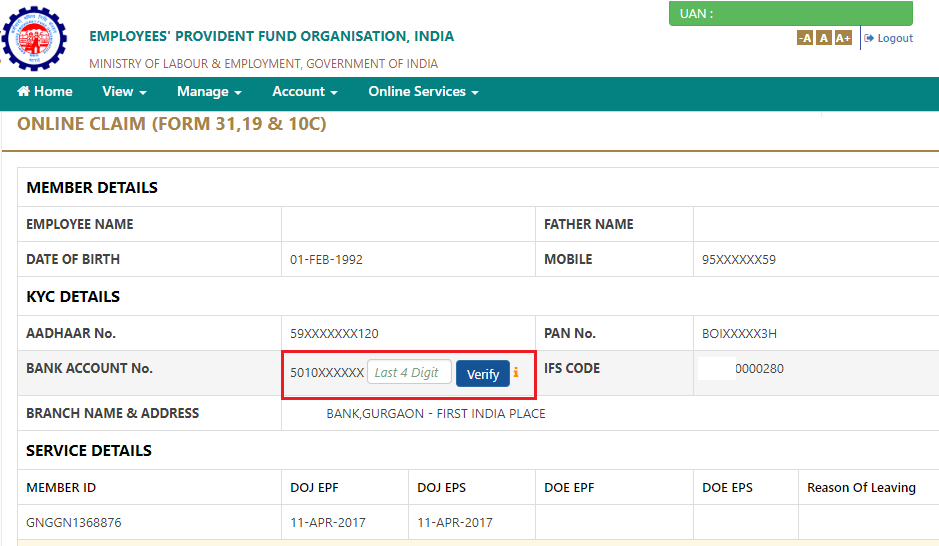

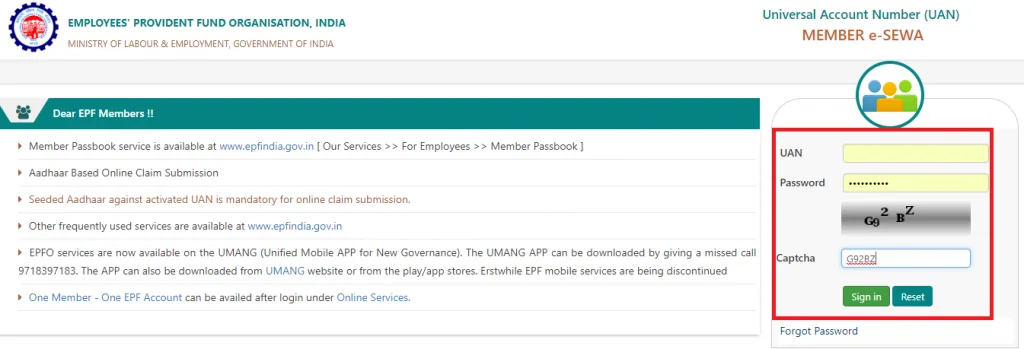

On this screen you need to enter the last 4 digits. Sections of this page. Employee who link their UAN and Aadhaar to their EPF account can seek approval for EPF withdrawal from their employers online.

EPF Account 1 dan EPF Account 2. If you have an education loan with PTPTN or. EPF Account 1 and EPF Account 2.

Marriage CertificateBirth Certificate for withdrawal to assist a spouse. 3 The employee must complete at least five years of service. EPF Account 2 Withdrwal For Housing Loan.

The savings in this account cannot be used for Housing Education Health and Age 50 Withdrawal. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. Here the funds will be divided between the two accounts.

4 The member can withdraw 12 times his basic monthly salary and dearness allowance. However on the safer side wait for it to turn more than 5 years. EPF Account 1 receives more.

Press alt to open this menu. Employees must have their active UAN bank details linked with their active UAN and details of their Aadhaar and PAN as seeded into the EPF database. Click on Online services from the top menu bar.

Viewpoint Did You Know That Pf Withdrawals Before Five Years Of Service Are Taxed

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Can Withdraw Epf For House Renovation Wallpaper

Epf Withdrawal Rules Here S How To Buy Your Dream Home With The Help Of Pf

How To Use Your Pf Provident Fund For Property Purchase Mint

How To Withdraw Pf Amount Both Through Online And Offline

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

How Much Do Epf Withdrawals Affect Your Retirement In The Long Run More Than You Think

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Pf Withdrawal Online Procedure Epf Withdrawal Form Rules Status

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Learn How To Withdraw Money From Epf Account Prematurely

How To Withdraw From Epf For Coronavirus

How Much Do Epf Withdrawals Affect Your Retirement In The Long Run More Than You Think

More Epf Withdrawals You Ll Probably Work Till The Day You Die Expert Says

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Comments

Post a Comment